Evidence places that rising cost of living is coming down fast, creating financial experts and financiers to pivot assumptions

The Financial institution of Canada is widely anticipated to elevate its trend-setting rate of interest today by a quarter of a percentage point, which would certainly bring it to 4.5 percent.

If it occurs, it’ll be the eighth time in a row that the bank has chosen to hike its benchmark price, which makes obtaining money much more costly for customers and services.

But also for the first time in practically a year, there isn’t a strong consensus among those that see the reserve bank that one more walking remains in the cards– or even whether one must be.

The bank is locked in a fight to wrestle rising cost of living into entry, as well as it believes price hikes are the best tool at its disposal to win that battle.

It’s a battle that’s racked up a lot of collateral damage, consisting of in the housing market, where average costs are down by 20 per cent considering that February. Other types of consumer financial debt, such as charge card, is additionally increasing to record degrees as Canadians battle to adjust to greater prices for just about every little thing.

Even so, the price walkings have so far just succeeded in bringing rising cost of living down from a 40-year high above 8 percent last summer season to 6.3 percent last month.

That’s still two times as high as the ceiling of the variety the financial institution suches as to see, which is why a bulk of financial experts assume another hike is in the homicide. However Pablo Villanueva, an economic expert with Swiss Financial institution UBS is amongst those that believes the most effective thing the Bank of Canada could do may just be nothing at all.

” The data given that December has actually shown an economic situation that is damaging,” he claimed, keeping in mind that Canada’s GDP likely only expanded by regarding one percent in the 4th quarter of 2022. That’s well down from the 3 percent standard for the remainder of the year. Wage gains and also the employment numbers paint a comparable picture.

A pair of the financial institution’s very own reports from earlier this month are also singing from the very same songbook, with a majority of consumers as well as companies telling the central bank they currently anticipate the economy to go into economic downturn this year.

Villaneuva says the recent information factors on Canada’s GDP as well as the recent rise of discharges amount to make a rather engaging case to stand on the sidelines for a while.

” We believe that this weaker expectation for the economic climate and rising cost of living must give the Bank of Canada self-confidence that it can resist on additional walks at least in the close to term,” he claimed.

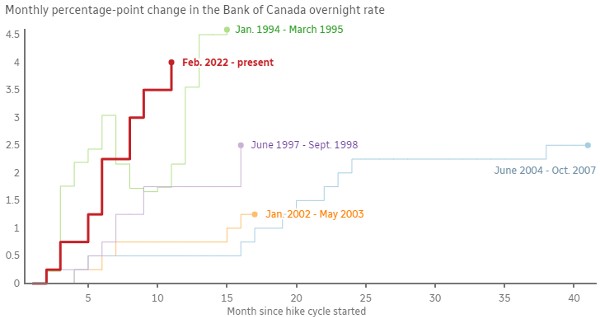

This rate hike cycle is faster and more unrelenting than any of the bank’s previous ones

A major factor to stand rub is that it generally takes in between six months to a year and also a half for the full impact of price walkings to be really felt anyhow.

A major factor to stand rub is that it generally takes in between six months to a year and also a half for the full impact of price walkings to be really felt anyhow.

” We acknowledge that we have raised interest rates rapidly which their impacts are functioning their means through the economic situation,” Sharon Kozicki, deputy guv of the Financial institution of Canada, informed a Montreal business audience last month.

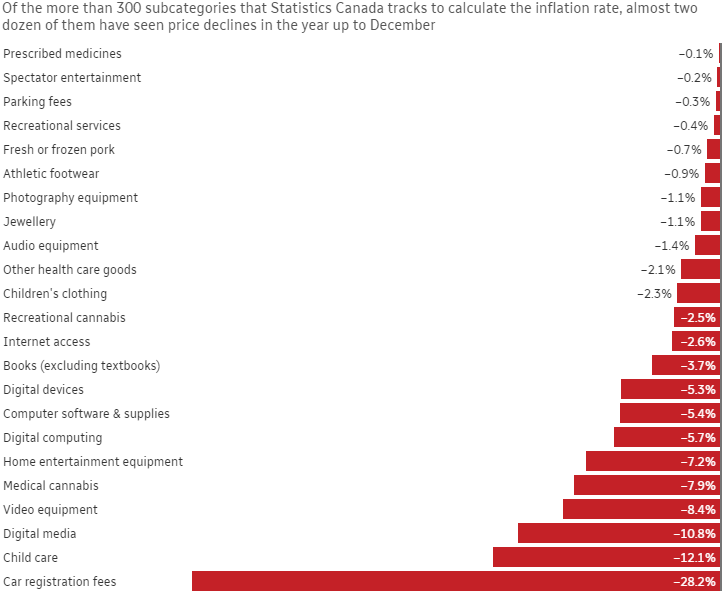

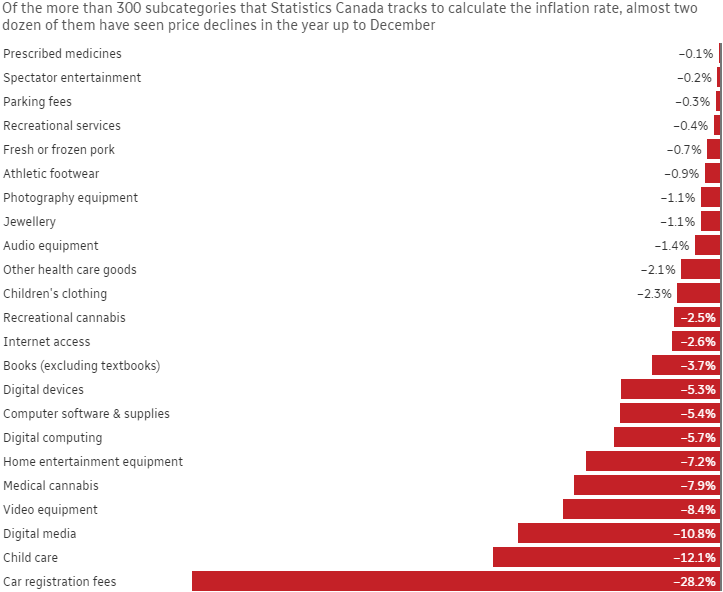

Not everything is getting more expensive

” To put it simply, we are relocating from just how much to raise rate of interest to whether to raise rate of interest,” she stated.

Karyne Charbonneau, a financial expert with CIBC, assumes the financial institution is likely to elevate again on Wednesday, yet she’s among those that assumes there probably isn’t another hike coming after that.

” If reserve banks are wise enough to recognize the delayed effects of what they’ve currently done, they will not have that much more price walkings to deliver,” she said.

The case for standing pat

While the headline inflation number remains to rise at an eye-watering rate, underneath the surface area it’s not hard to locate products and services that are in fact more affordable currently than they utilized to be.

Almost 2 lots of the 300-odd subcategories that Data Canada tracks are now in unfavorable area for the year, consisting of publications, computer and electronic equipment, kids’s clothing as well as footwear.

Slightly more affordable medicine and vehicle parking charges might be chilly comfort to any person who attempted to fill up a gas container recently– or a grocery store cart. Yet as demand wanes for products as well as solutions, increasingly more products will certainly move into that unfavorable variety, dragging the overall inflation price down with them.

So if the financial institution is seeking justifications to take a pause, it’s not difficult to locate them.

Stephen Gordon, a professor of business economics at l’Université Laval in Ste-Foy, Que., has been tracking the shorter term inflation trends for greater than a year now online. He notes that the annualized inflation rate over the previous three months is now down to below four per cent. A year ago, it was greater than three times that.

Financiers, too, seem less positive than they have actually been all year that the financial institution is poised to trek once more. Trading in financial investments known as swaps on Monday suggest the market assumes there has to do with a three-in-four opportunity of a hike on Wednesday– however that indicates there’s a one-in-four possibility that there won’t be one.

That’s the very first time that figure has actually been anything much less than a certainty because the bank began treking last February, and an indicator that capitalists are betting real bucks that winds of financial plan might be blowing in a various direction quickly.

Despite what occurs today Gordon claims the real examination for inflation will certainly remain in the February numbers, because that will certainly be one year given that Russia invaded Ukraine, which kicked already-underway inflation into high equipment.

” I can see a case for providing a pause,” he claimed in an interview with CBC Information on Monday. “Yet we’re still in wait and see mode regarding the information.”

Last Updated: 25 January 2023