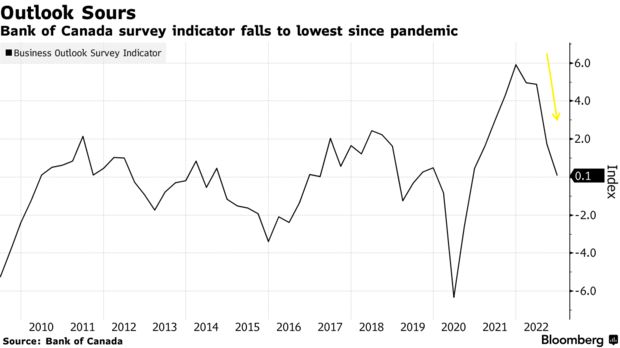

Surveys show higher borrowing expenses are beginning to bite

Inflation assumptions continue to be high as Macklem evaluates following move

View among Canadian firms goes to its cheapest given that the Covid-19 pandemic and also inflation expectations stay elevated, Bank of Canada studies show.

The central bank’s service overview sign fell to 0.07 in the fourth quarter, from a changed 1.74 previously. About 70% of services see the economy heading right into an economic downturn, as well as much more firms than typical expect their sales to decline. Greater rate of interest and inflation have likewise restricted the capability of consumers to invest, the financial institution claimed in a separate study.

The data recommend the Bank of Canada won’t need to raise rate of interest much better in order to bring need as well as supply back into equilibrium, and that in 2015’s hostile walkings are already functioning to reduce development.

” The survey information very much recommends that the financial institution might be quite close to completion of its tightening cycle,” Toronto-Dominion Bank planners Andrew Kelvin as well as Robert Both said in a report to capitalists. However, “the financial institution can ill pay for an early time out in 2023.”

Many workers do not expect their earnings to catch up with recent cost stress, and also regarding fifty percent of homes think they will certainly be adversely influenced by a possible recession. Concerning half of customers that expect a recession believe it will be modest in extent and size, while 90% of organizations expect it to be mild.

Guv Tiff Macklem and his officials have actually slowed down the rate of rate walkings and also indicated that future decisions will certainly rely on economic information. The reserve bank has currently raised borrowing expenses by 4 percent points since last March, bringing the benchmark over night price to 4.25%.

The studies and December’s inflation report from Statistics Canada– due Tuesday morning– are the final significant inputs right into the central bank’s Jan. 25 policy choice. Traders in overnight swaps markets were putting the odds of a 25-basis-point walk at more than 80%.

The yield on benchmark two-year Canada bonds went to 3.586% as of 1:14 p.m. Ottawa time, down 8 basis factors from Friday’s close as well as somewhat below its trading degree prior to the survey release.

The comparison in between the weakening business outlook as well as a recent string of stronger-than-expected economic data complicates the bank’s plan reaction.

While the heading annual rising cost of living price eased in November, underlying price pressures trended higher. Early quotes recommend the economy is on track to increase at an annualized rate of 1.2% in the last quarter of 2022– more than double the Bank of Canada’s forecast. Last month, the labor market blew past expectations and also added greater than 100,000 jobs, while the joblessness rate fell to near a record low of 5%.

Four out of Canada’s six biggest bank currently anticipate an additional price hike from Macklem, with Canadian Imperial Financial Institution of Business and also Royal Financial institution of Canada transforming their projection after the blowout tasks report.

Last Updated: 16 January 2023