UK, European Union both offering jumbo bond deals on Tuesday

Worldwide credit report is rallying, reducing funding expenses for issuers

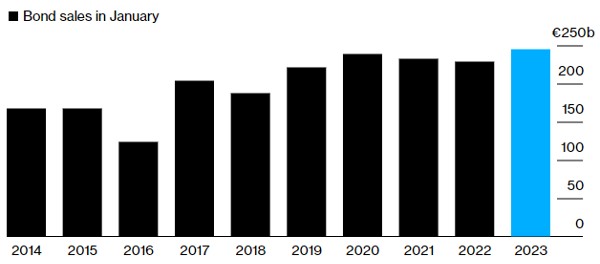

Financial obligation sales in Europe have appeared EUR240 billion ($ 260 billion), defeating a previous document for January embeded in 2020.

Offerings from the UK and European Union on Tuesday pressed marketwide sales this month to a minimum of EUR244 billion, with the last tally readied to move even higher once last terms are set on Tuesday’s eight offerings, according to information compiled by Bloomberg. It beats a previous record of simply under EUR239 billion notched up in the same month 3 years back.

Record European Bond Sales in January 2023

” Providers are simply ending up being much more mindful that when there’s a home window they simply need to see to it they get out instead of waiting,” stated David Zahn, head of European set income at Franklin Templeton, which is overweight on European credit history. “This year, the ECB is likewise going to be fairly prominent on just how its plan rate goes, so companies are believing that it is just going to obtain much more expensive to market bonds, particularly if you release in the much shorter end.”

Consumers have been loading in to public debt markets throughout a start-of-year global credit score rally that’s increasing business bond returns as well as driving down funding prices. Banks particularly have been active, hurrying to connect a financing void as they prepare to shortly pay back even more of the pandemic-era low-cost fundings made available by the European Central Bank.

It’s currently resulted in the busiest-week ever before for debt handle the area, with more than EUR100 billion increased in the five days via Jan. 13 as issuers like Deutsche Bank AG as well as Credit report Agricole SA gathered to the marketplace.

It marks a magnificent turnaround from a disappointing 2022 for international credit report markets, when central banks’ initiatives to include surging inflation buffeted issuance task and on some days closed the door to any financial obligation sales whatsoever.

Customers will price at least EUR15 billion equivalent in Europe’s financial debt market on Tuesday, led by a ₤ 6 billion ($7.38 billion) UK gilt sale that’s amassed greater than ₤ 65 billion of orders, according to an individual with expertise of the process, who asked not to be recognized as the information is personal. A EUR5 billion offering from the European Union has actually gathered virtually EUR52 billion of orders, a separate individual with knowledge of that sale claimed.

Last Updated: 24 January 2023