National Financial Awareness Day

How much do you want to bet that most people don’t realize August 14 is National Financial Awareness Day?

It’s more significant than you might think. After all, what’s more satisfying than achieving financial independence? Imagine the relief of living without the constant worry of debt. Making wise financial choices now can have a big impact on your future. Retirement should be a time to enjoy the vacations you couldn’t take while working. Since money plays a key role in our overall well-being, Financial Awareness Day is the perfect opportunity to assess your current financial situation and plan for the future. Don’t let poor financial decisions spoil the best years of your life!

Financial Awareness for Students

In honor of National Financial Awareness Day, we’ve put together a list of five valuable resources to help students navigate major financial decisions in the near future.

When is National Financial Awareness Day 2024?

Start saving, investing, and building up that nest egg on National Financial Awareness Day on August 14.

History of National Financial Awareness Day

Do you spend money extravagantly like in “The Great Gatsby”? Are you saving for retirement but unsure where all your money is going? Or do you live paycheck to paycheck? No matter your financial situation, it’s time to step back, see the big picture, and commit to becoming more mindful of your spending. Many of us wait until our birthday or the new year to organize our finances, but today is the perfect time to start. August 14 is National Financial Awareness Day, a timely reminder to take saving and investing seriously to build financial stability and secure your future.

The origins of this day may be unclear, but its purpose is clear: to encourage the development of good financial habits that will strengthen your current financial status and support you through retirement. By investing, we can make our money work for us, reducing the time spent working and giving us more time to enjoy life. David Ravetch, a senior accounting lecturer at UCLA, points out, “We live in a world of financial illiteracy.” This means that many of us lack the knowledge and skills needed to make informed financial decisions with the resources we have.

While it might seem daunting, everyone can learn sound financial principles and start saving. Small changes to daily habits can lead to significant financial rewards. Finances can become much simpler when we differentiate between wants and needs and take stock of our spending. Joining an investment or money management club, consulting a financial advisor, or exploring books and blogs on personal finance are all excellent ways to get started.

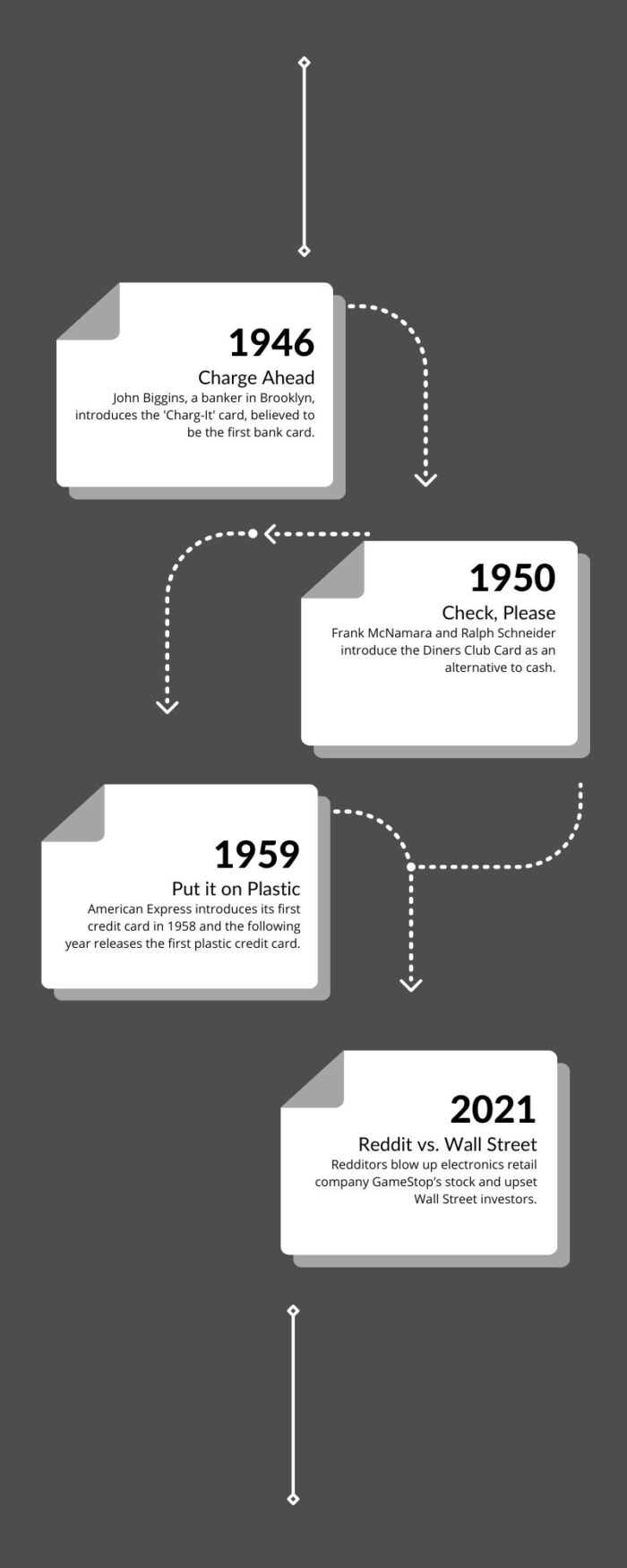

National Financial Awareness Day timeline

By The Numbers

Here are some eye-opening financial statistics:

58%- of Americans have less than $1,000 in savings.

8%- of U.S. citizens believe they will never recover from the recession.

$2,000- is the average emergency savings for millennial Americans.

20%- of Americans don’t save any portion of their annual income.

50%- of American households live paycheck to paycheck.

32%- of U.S. families maintain a household budget.

$1- trillion is the total credit card debt held by Americans.

44%- of Americans don’t have enough cash to cover a $400 emergency.

24%- of millennials show basic financial literacy.

40%- of student loan borrowers aren’t making payments.

68 cents- is what women saved for every dollar saved by men in 2020, down from 70 cents in 2019, according to LT Trust.

National Financial Awareness Day FAQs

What is National Financial Awareness Day?

National Financial Awareness Day is a holiday focused on educating people about finances and helping them prepare for financial stability.

What does financial awareness mean?

Financial awareness is the ability to manage your finances and income effectively and efficiently.

How can I improve my financial IQ?

Your financial IQ depends on your current financial situation and goals. To improve it, you can read extensively about personal finance, compare your net worth with your spending, consult with an accountant or financial advisor, and practice saving and budgeting as much as possible.

How to Observe National Financial Awareness Day

1. Invest

Got some extra cash you’re tempted to splurge? Instead of spending it on a fleeting luxury, why not consider investing it for a potential return? Investing offers a rare chance to put your money into something that can grow over time — unlike a trip to Vegas, where the odds aren’t in your favor. In the long run, playing it safe with investments is much more rewarding than spending it all. Use National Financial Awareness Day as your motivation to start investing; it’s a decision that’s likely to pay off!

2. Take a Trip to the U.S. Mint

What better way to celebrate money than by seeing how it’s made? The U.S. Mint has four locations: Philadelphia, Denver, San Francisco, and West Point. If coins aren’t your thing, visit the U.S. Bureau of Engraving and Printing (BEP). They offer tours, rare currency products, and even the chance to redeem those worn-out dollars you accidentally ran through the wash. Now that’s smart money management!

3. Get Smart About Your Money

National Financial Awareness Day is the perfect time to create a budget. It might not be the most exciting task, but it’s incredibly important. Track your spending by making a spreadsheet or using one of the many apps or online services available. The results might surprise you, but remember — knowledge is power!

Why National Financial Awareness Day is Important

A. It Celebrates Easy Street

As the saying goes, why work for your money when you can make it work for you? In the constant hustle to earn a living, we often forget that the journey doesn’t always have to be uphill. With the right knowledge and strategies, you can make the road to financial success smoother and more enjoyable. Sound investment practices allow you to spend less time working and more time living.

B. It Teaches Us That Finances Don’t Have to Be Confusing

In a world where financial literacy is rare, even a little knowledge can give you a big advantage. Many people find finance intimidating, but understanding how money works can set you apart. It’s like being the go-to friend for financial advice — the one everyone envies for knowing how to manage money wisely. And when your car breaks down, you won’t just know how to fix it; you’ll be able to afford a better one!

C. It Reminds Us to Prepare for the Unforeseeable Future

They say money can’t buy happiness, but lacking money can certainly bring stress. That’s why making smart financial decisions today is crucial to avoid hardship tomorrow. Life is unpredictable, and there’s no better safety net than a solid contingency fund. Preparing now ensures you’re ready for whatever challenges come your way.

National Financial Awareness Day dates

| Year | Date | Day |

|---|---|---|

| 2024 | August 14 | Wednesday |

| 2025 | August 14 | Thursday |

| 2026 | August 14 | Friday |

| 2027 | August 14 | Saturday |

| 2028 | August 14 | Monday |

Also Read:

Women’s and Family Day

World Elephant Day

International Youth Day