Individuals struggling with the rising cost of living are cutting back on food as well as automobile journeys to conserve cash, according to a BBC-commissioned survey.

Majority (56%) the 4,011 individuals asked had actually gotten fewer groceries, as well as the very same percentage had missed meals.

The searchings for reveal the extensive effect of costs rising at their fastest rate for 40 years.

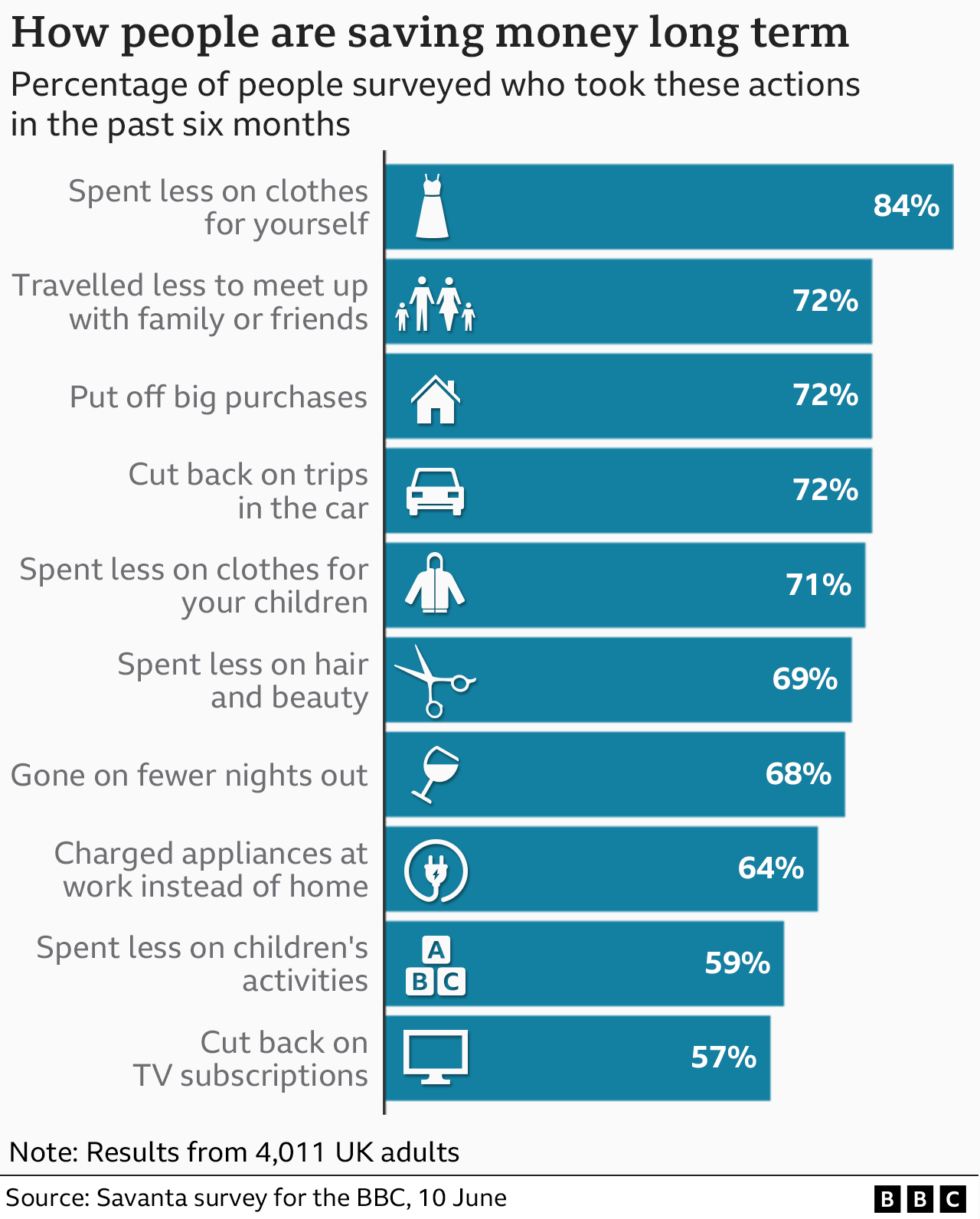

Many people have reduced costs on garments and socializing. Some claim their mental health has actually been impacted.

Two-thirds of those evaluated also recommended government assistance given so far was insufficient.

Worries growing

The price of domestic power, petroleum, and also food have all increased considerably in recent months, and also the searchings for suggest greater than 8 in 10 individuals (81%) are bothered with the rising cost of living.

- ‘ We can not simply enter there and also get what we like currently’

- Why are rates climbing so rapidly?

- 5 things that are increasing in cost and why

- Why chicken is getting more and more costly

Concern has actually grown given that the begin of the year when 69% of those asked claimed they were worried in a comparable BBC study.

In the most up to date results, two thirds (66%) of those with fears stated this was having a negative result on their mental health and wellness. Almost fifty percent (45%) said their physical health and wellness had actually been affected.

Day-to-day, individuals are making additional changes to handle their budgets. The study suggests this can be as simple as going on fewer nights out, or obtaining a haircut less often.

Day-to-day, individuals are making additional changes to handle their budgets. The study suggests this can be as simple as going on fewer nights out, or obtaining a haircut less often.

For charity worker Janine Colwill, from Easington, and those she speaks to, the changes have been a lot more essential.

” We obtain together with the family every Sunday, consistently, for Sunday roast – however my family members and also various other family members are starting to expand their very own vegetables,” she stated.

” Those people who may not have actually worried about these things previously are now worrying about them regularly.

” Those people who may not have actually worried about these things previously are now worrying about them regularly.

” With developments in technology, I never would have thought that people would certainly be depending on a food bank or growing their very own – as well as simply frugal,” she said.

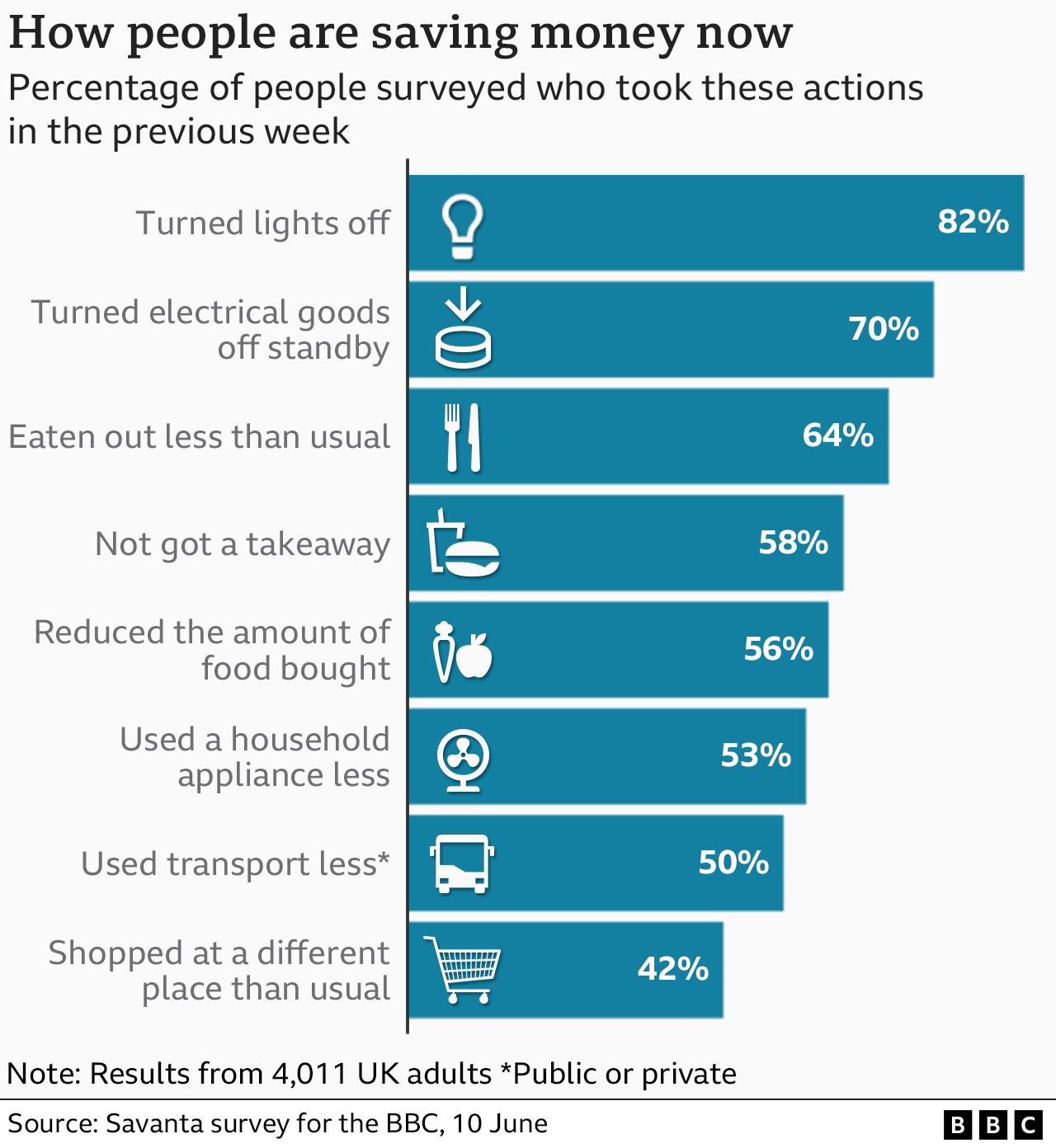

The study recommends individuals are discovering numerous ways to manage as well as conserve their cash. The findings consist of:

- Some 82% of those asked had switched off lights in the previous week to save cash

- Journeys taken in the auto had actually been restricted to differing levels in the previous six months by 72% of those asked

- A large majority (84%) stated they had actually invested less on their garments at some time in the previous six months

About half (52%) expect to work more hours in the next six months to assist to foot the bill.

Prices, as determined by rising cost of living, are increasing at a price of 9% a year, the fastest for 40 years. Rate of interest, which additionally affect the cost of living, were boosted to 1.25% on Thursday by the Bank of England – the greatest they have actually been for 13 years.

Prices, as determined by rising cost of living, are increasing at a price of 9% a year, the fastest for 40 years. Rate of interest, which additionally affect the cost of living, were boosted to 1.25% on Thursday by the Bank of England – the greatest they have actually been for 13 years.

The circumstance is being driven, to a significant degree, by global elements such as the expense of oil, gas as well as food.

But there are UK-specific concerns which are including in inflation such as the limited work market. Task openings go to a record high of 1.3 million definition employers face paying greater salaries to load roles.

Also, the UK’s dominant services field – which includes the similarity book-keeping and also law practice, along with restaurants and clubs – is seeing cost surges.

Vehicle drivers currently need to invest ₤ 103 for gas and ₤ 106 for diesel to fill up a family members auto, according to the RAC. The Institute of Grocery Store Distribution (IGD) has forecasted food costs will certainly climb at a rate of 15% this summertime as homes pay even more for staples such as bread, meat, dairy products and also vegetables and fruit.

A regular family in England, Wales and Scotland is most likely to see an increase in its annual domestic gas as well as electrical energy expense of ₤ 800 in October, on top of a ₤ 700 surge in April.

The rise in rising cost of living is hitting vast and hitting deep, with the effects resulting in substantial modifications in the way lives are being lived well past those on low incomes.

Big swathes of Britain’s middle income working households are needing to make material cutbacks as well as also afterwards are part of a brand-new class of those “just about handling”.

In practice this has actually suggested power expense direct debits erasing people’s whole disposable revenue, some food banks running out of food donations, or their benefactors ending up being customers.

As well as it may be altering attitudes, with virtually two-thirds of those asked stating also after the recent plan of assistance for power bills from the federal government, that it is not enough. And also the numbers recommend a similar percentage assume the assistance in position needs to last at least a year longer.

Rising cost of living this high definitely alters the economic climate and also our investing practices.

Yet the numbers increase a concern concerning whether the high degrees of government support in the pandemic and in this power crisis also, are currently ending up being baked right into public assumptions.

Skyrocketing prices have led the government to introduce a bundle of financial backing routed largely at those on low revenues. This consists of a ₤ 400 discount rate on all power costs in October, in addition to settlements totalling ₤ 650 to individuals on means-tested advantages. Pensioners will certainly get much more this winter, as will certainly billpayers with specials needs.

Nevertheless, the BBC survey exposes that 64% of those asked claimed this assistance was insufficient to assist people with the increasing expense of living.

Principal Assistant to the Treasury Simon Clarke said prone households would certainly receive ₤ 1,200 which he stated became part of a “very large” amount of support, on top of what had already been supplied.

He stated the very first payments would be available in July, and would proceed right into the fall to offset the crucial chauffeur of the rising cost of living for families, which was power expenses.

” That, naturally, is yet to infiltrate to people, which is why I think people are claiming they want a lot more support,” he told the BBC.

” As this gathers speed, it will be clear to individuals that this will be a detailed plan.”

The effect of rising home expenses has actually already led to the financial regulatory authority advising lenders that they need to do more to aid those in economic trouble and support prone clients.

“Early activity is essential for those battling with debt,” said Sheldon Mills, of the Financial Conduct Authority.

Disclaimer: TheWorldsTimes (TWT) claims no credit for images featured on our blog site unless otherwise noted. The content used is copyrighted to its respectful owners and authors also we have given the resource link to the original sources whenever possible. If you still think that we have missed something, you can email us directly at theworldstimes@gmail.com and we will be removing that promptly. If you own the rights to any of the images and do not wish them to appear on TheWorldsTimes, please contact us and they will be promptly removed. We believe in providing proper attribution to the original author, artist, or photographer.

Resources: BBC

Last Updated: 17 June 2022