India’s economic climate kept its energy in April as a bigger resuming from the pandemic maintained climbing rates from dispiriting need for the time being.

India’s economy kept its momentum in April as a bigger reopening from the pandemic kept climbing costs from depressing demand for the time being.

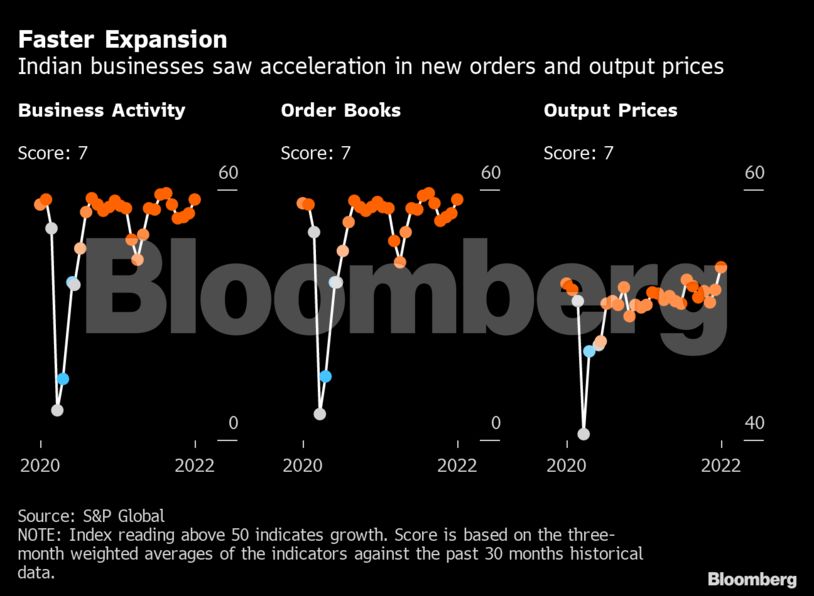

Activity in the services sector along with manufacturing facilities gotten last month, while the three-month heavy standards of month-to-month adjustments in indications from exports to credit need recommended enduring stamina. That aided maintain the needle on a dial gauging supposed ‘Animal Spirits’ constant at 5 for the 10th straight month.

While April noted India’s very early actions toward living with the infection, including the first full-month of industrial international trips after 2 years, risks loom for the economic situation as the battle in Ukraine followers inflation and also lockdowns in China stress supply chains. India’s government and also its central bank acted in tandem this month to counter price pressures, with steps such as tax obligation cuts and a surprise increase in loaning costs.

While April noted India’s very early actions toward living with the infection, including the first full-month of industrial international trips after 2 years, risks loom for the economic situation as the battle in Ukraine followers inflation and also lockdowns in China stress supply chains. India’s government and also its central bank acted in tandem this month to counter price pressures, with steps such as tax obligation cuts and a surprise increase in loaning costs.

Book Financial Institution of India Guv Shaktikanta Das, who results from lead a conference of the policy panel next month, has actually signified extra tightening to maintain inflation from denting home investing power.

Below are information of the dashboard.

Business Activity

Purchasing supervisors’ surveys showed solutions sector activity in April grew at this year’s toughest pace, while producing additionally showed growth. That assisted the S&P Global India Composite PMI expand at the fastest rate in five months to 57.6– much above the 50 limit that separates growth from tightening.

The task backed by more powerful brand-new orders was gone along with by a bump in result rates as manufacturers began passing on high raw material costs to customers. That’s a threat to headline rising cost of living, which climbed to an eight-year high in April.

Exports

Exports

Exports grew at this year’s fastest speed, rising 30.7% in April from a year ago to $40.2 billion, although in value terms that was less than the $42.2 billion seen a month prior. Imports also rose 31% to $60.3 billion as high assets prices rose the expense for every little thing from crude to edible oils. That widened the trade shortage to $20.1 billion from $18.5 billion in March.

Consumer Activity

Consumer Activity

The automobile industry remained to be born down by a worldwide supply crisis, with passenger lorry sales dropping 10% in April from a month earlier. The car industry sees rate rises moistening consumer belief.

Other indicators of consumer task were encouraging however, with financial institution credit growing 11.1% towards completion of last month from 9.6% in end-March. Liquidity conditions remained to continue to be in surplus.

Industrial Activity

Industrial Activity

Manufacturing facility outcome growth got, increasing 1.9% in March from 1.5% in the previous month, helped by electricity and mining. The result development of eight framework industries slowed down to 4.3% from 6% in February as coal and also crude oil result fell from a year earlier. Both the records are published with a one-month lag.

Disclaimer: TheWorldsTimes (TWT) claims no credit for images featured on our blog site unless otherwise noted. The content used is copyrighted to its respectful owners and authors also we have given the resource link to the original sources whenever possible. If you still think that we have missed something, you can email us directly at theworldstimes@gmail.com and we will be removing that promptly. If you own the rights to any of the images and do not wish them to appear on TheWorldsTimes, please contact us and they will be promptly removed. We believe in providing proper attribution to the original author, artist, or photographer.

Resources: NDTV

Last Updated: 27 May 2022