Falling inflation and also assumptions that the Federal Reserve will certainly turn more dovish provided the supply an increase in January.

Amazon.com stated it would certainly increase Buy with Prime to all qualified vendors and announced a brand-new drug store advantage for Prime participants.

The business likewise expanded business layoffs from 10,000 to 18,000 individuals, revealing it’s concentrated on reducing expenses.

Changing market belief and also several news lifted the supply last month.

What happened

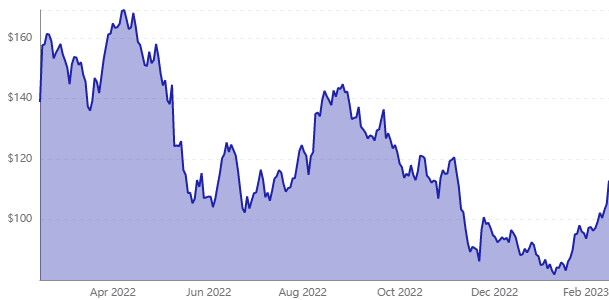

Shares of Amazon (AMZN 7.38%) rose last month as it rode a broader healing in technology supplies and made a variety of operational statements that appeared to position the business to return to profitable development.

According to information from S&P Global Market Knowledge, the stock completed January up 23%.

So what

With the Nasdaq acquiring 11% last month, more comprehensive tailwinds out there were a huge factor for Amazon’s gains. Rising cost of living continued to cool down, and also investors anticipated that the Federal Reserve would continue to reduce its interest rate walkings, which it did on Feb. 1, raising the government funds rate by simply 25 basis factors, its slowest walking in near to a year. As an intermittent company trading at a high appraisal, Amazon will certainly gain from a stagnation in interest rate walks and if the economy can stay clear of a significant recession.

When it comes to the business itself, there were numerous story that appeared to drive the supply higher. First, Amazon stated it would certainly broaden the layoffs it revealed in November from 10,000 to 18,000. Though layoffs imply real people shedding their jobs, they commonly result in stock gains, as it reveals that a firm is checking prices.

Amazon also announced that it would open its Buy with Prime program to any eligible sellers in the united state. The Buy with Prime program enables on-line sellers on systems beyond Amazon.com to include the Prime badge to listings and also supply Prime members free shipping and returns. The relocation drastically broadens the addressable market for Amazon’s logistics solutions and might move the needle under line.

Finally, the company also announced that it would add a pharmacy advantage to Prime, called RxPass, that permits consumers to obtain usual generic drugs delivered for a flat regular monthly charge of $5.

Buy with Prime and also RxPass both reveal Amazon.com remaining to expand its community also as it cuts costs through layoffs as well as various other steps.

Now what

Amazon.com’s fourth-quarter profits record is due after hours on Thursday, as well as capitalists appear to assume the stock will soar after Meta Operatings systems did the same following its revenues report yesterday. Analysts anticipate simply 6% top-line growth as well as a high drop in earnings, which could provide the firm a low bar to jump over, but it likewise reveals the challenges Amazon.com is encountering.

With today’s gains, the supply is up roughly 40% given that its base last December, revealing a significant change in sentiment toward Amazon supply. The principles will need to improve for the stock to maintain getting.

Should you invest $1,000 in Amazon.com right now?

Before you think about Amazon.com, you’ll wish to hear this.

The Motley Fool Supply Advisor expert team just disclosed their 10 Ideal Acquires Currently … and Amazon.com had not been one of them.

Last Updated: 03 February 2023